Crypto News

Deutsche Bank Set to Become Banking Partner for Bullish - The Crypto Exchange Listed on NYSE!

/index.php

Bisnis | Ekonomi - Posted on 08 August 2025 Reading time 5 minutes

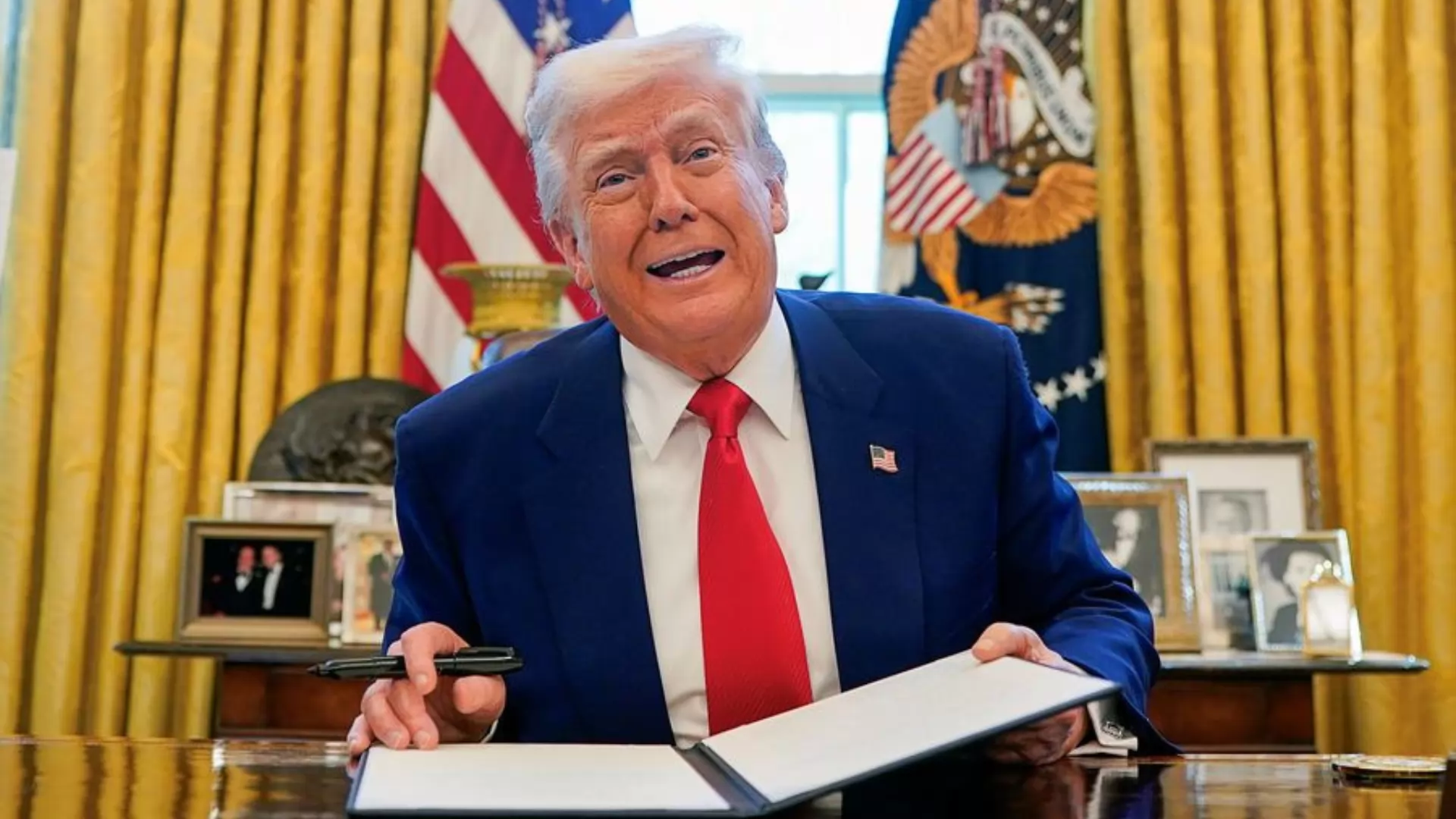

Indonesia’s foreign exchange reserves are currently under pressure from external debt repayments and the potential impact of a 19% import tariff on Indonesian goods imposed by U.S. President Donald Trump’s administration. So far, the tariff policy has not yet affected export performance — one of the nation’s main sources of foreign reserves. However, once it takes effect on August 7, 2025, the 19% tariff is projected to suppress Indonesian exports to the U.S., which is the country’s second-largest export destination after China.

According to Bank Indonesia (BI), the nation’s foreign exchange reserves stood at US$152.0 billion in July 2025, down from US$152.6 billion the previous month. The highest reserves on record were in March 2025 at US$157.1 billion, before declining in subsequent months. Reserves remained relatively stable at around US$152.5 billion from April 2025 before falling again in July, partly due to external debt servicing.

BI’s Head of Communications Department, Ramdan Denny Prakoso, explained that this development was influenced by government external debt repayments and BI’s efforts to stabilize the rupiah in response to persistent global financial market uncertainty.

As of May 2025, Indonesia’s external debt stood at US$435.6 billion, equivalent to Rp7,100.28 trillion (based on BI’s JISDOR exchange rate of Rp16,300 per U.S. dollar at end-May 2025). This was an increase of US$4.05 billion, or about Rp66 trillion, from the previous month. While the amount rose in U.S. dollar terms, it declined in rupiah terms due to currency appreciation in May. Year-on-year (YoY), external debt grew by 6.8%, lower than April’s 8.2% growth, due to slower public sector debt expansion and a contraction in private sector debt.

Ramdan added that BI intervened in the financial markets to maintain rupiah stability amid global economic uncertainty, particularly following President Trump’s announcement of reciprocal tariffs against multiple countries ahead of their enforcement. At the end of July 2025, reserves were equivalent to financing 6.3 months of imports, or 6.2 months of imports plus government external debt payments — well above the international adequacy standard of about 3 months. BI considers this level sufficient to support external sector resilience, maintain macroeconomic and financial stability, and sustain positive investor sentiment toward Indonesia’s economic outlook and investment returns.

The 19% Trump tariff, effective August 7, 2025, is aimed at balancing the U.S. trade relationship with Indonesia, which for years has shown a consistent U.S. trade deficit. U.S. trade statistics for 2020 through the first half of 2025 show a total of US$101.7 billion, with the U.S. deficit representing a surplus for Indonesia.

The policy has sparked concerns among both government and business circles that U.S. demand for Indonesian goods may fall. In the first half of 2025, Indonesia’s trade surplus with the U.S. was recorded at US$9.9 billion by Statistics Indonesia (BPS), while U.S. data put the surplus at US$11.7 billion. This strong performance is not expected to last after the tariff takes effect.

BCA Chief Economist David Sumual confirmed BI’s data, noting that external debt payments and the maturity of Bank Indonesia Rupiah Securities (SRBI) last month accounted for a significant drawdown in reserves. Nevertheless, he believes Indonesia’s external position remains manageable, as foreign holdings in government bonds (SBN) remain positive year-to-date, offsetting net foreign outflows from the equity market.

David projects that Indonesia’s foreign reserves will range between US$150 billion and US$155 billion by the end of 2025, assuming the government issues Australian dollar and Chinese yuan-denominated bonds, such as Kangaroo Bonds and Dimsum Bonds. He also forecasts the rupiah to trade between Rp16,300 and Rp16,600 per U.S. dollar.

Source: bisnis.com

What do you think about this topic? Tell us what you think. Don't forget to follow Digivestasi's Instagram, TikTok, Youtube accounts to keep you updated with the latest information about economics, finance, digital technology and digital asset investment.

DISCLAIMER

All information contained on our website is summarized from reliable sources and published in good faith and for the purpose of providing general information only. Any action taken by readers on information from this site is their own responsibility.