Crypto News

Could Be a Surprise! This Altcoin May Skyrocket If October 2025 ETF Gets Approved!

/index.php

Bisnis | Ekonomi - Posted on 21 May 2025 Reading time 5 minutes

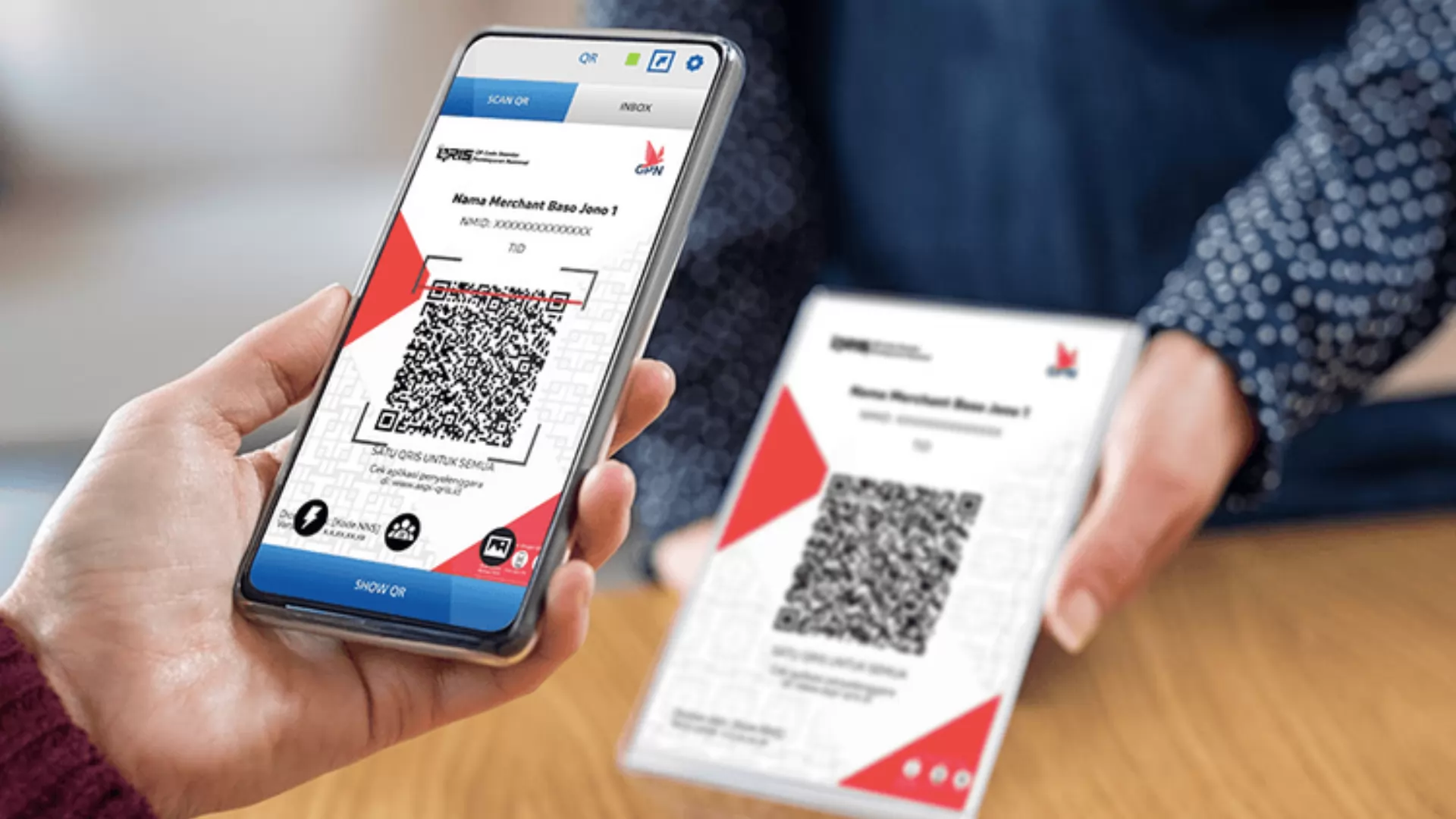

Behind the growing ease of digital transactions sweeping across Indonesia lies a local innovation called the Quick Response Code Indonesian Standard (QRIS), which has significantly improved everyday life. In fact, the emergence of this solution has made global payment giants Visa and Mastercard reconsider their dominance.

Even former U.S. President Donald Trump raised concerns about the use of QRIS.

The U.S. viewed the adoption of this financial technology as a barrier to digital trade and a limitation on American companies' access to the Indonesian market, particularly due to QRIS’s incompatibility with international payment systems.

So, who is behind QRIS? In this increasingly digital age, QRIS has made payments much simpler.

But do you know the journey behind this innovation before it became the unified QR code standard for payments in Indonesia? Let’s explore the fascinating history behind QRIS.

Before QRIS arrived like a "lifesaver," the digital payment landscape in Indonesia was heavily fragmented.

Each Payment System Service Provider (PJSP) had its own QR code format, leading to inefficiencies and inconvenience for both users and merchants.

Imagine a merchant having to display multiple QR code stickers from different payment apps, while consumers were forced to install numerous applications just to make transactions at different locations.

In response to this complexity, Bank Indonesia (BI) and the Indonesian Payment System Association (ASPI) took the initiative to standardize all QR formats into one national system.

This visionary move aimed to create a more efficient, accessible, and user-friendly digital payment ecosystem for all segments of the population.

Following a series of extensive pilot trials, QRIS was officially launched on August 17, 2019, coinciding with Indonesia's 74th Independence Day.

This historic date marked a new era for Indonesia’s payment systems.

Although QRIS was a collective initiative by Bank Indonesia and ASPI, recognition should be given to the experts and teams from both institutions who worked tirelessly to achieve this national standardization.

Perry Warjiyo, who served as the Governor of Bank Indonesia during QRIS’s launch, played a crucial role in promoting this innovation as part of a broader effort to modernize the national payment infrastructure.

Interestingly, before QRIS became Indonesia’s standard, the QR Code itself was created by Masahiro Hara, a Japanese engineer from Denso Wave (a Toyota subsidiary), in 1994.

Originally, QR Codes were developed to enable fast and accurate tracking of automotive parts. Over time, the technology expanded into various industries—including digital finance.

In building QRIS, Bank Indonesia and ASPI adopted the international EMVCo standard (from Europay, Mastercard, and Visa) to ensure transaction security and interoperability.

Since its debut, QRIS has continuously evolved and adapted. Bank Indonesia gradually mandated all PJSPs to implement QRIS, with a migration deadline of December 31, 2019.

This move successfully eliminated QR code fragmentation, enabling users to make payments at various merchants using just one QR code and one QRIS-compatible application.

Today, QRIS is not only simplifying payments at physical stores but is also expanding into other use cases such as online payments, charitable donations, and integration with other financial services.

Bank Indonesia is even working on cross-border QRIS payments to further maximize its benefits—especially in supporting tourism and small-medium enterprises (SMEs) engaged in international transactions.

The story of QRIS reflects a powerful example of innovation driven by the need to solve real-world problems and improve convenience.

Thanks to the collaborative work of BI and ASPI, QRIS has become more than just a payment solution—it has laid the groundwork for Indonesia’s advancing digital economy.

Source: suara.com

What do you think about this topic? Tell us what you think. Don't forget to follow Digivestasi's Instagram, TikTok, Youtube accounts to keep you updated with the latest information about economics, finance, digital technology and digital asset investment.

DISCLAIMER

All information contained on our website is summarized from reliable sources and published in good faith and for the purpose of providing general information only. Any action taken by readers on information from this site is their own responsibility.