Saham News

Foreign Investors Quietly Buy These 10 Stocks - Check the List!

/index.php

Investasi Digital - Posted on 16 March 2025 Reading time 5 minutes

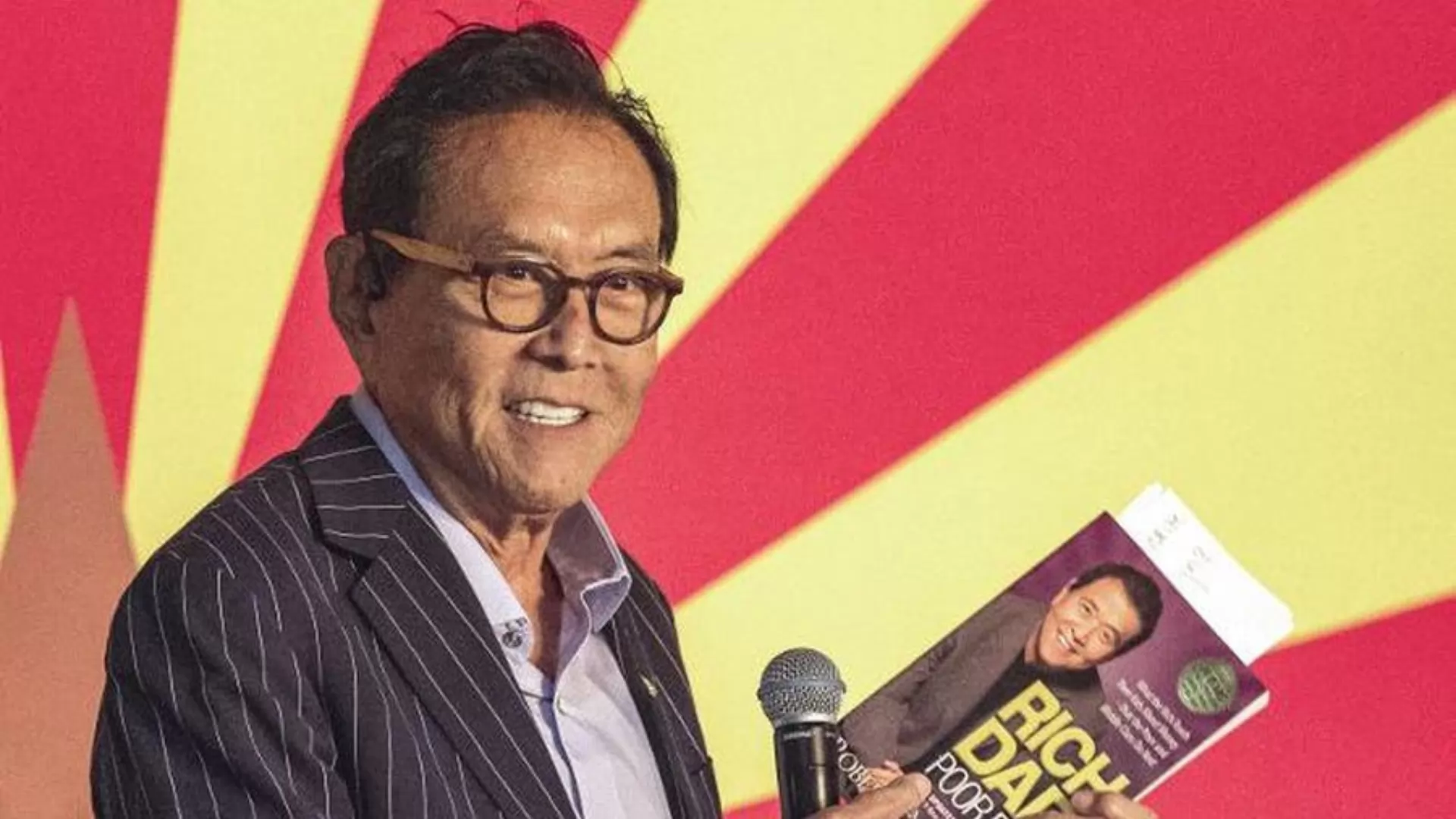

Bestselling author of Rich Dad Poor Dad, Robert Kiyosaki, has predicted that the US dollar will face a tough road ahead due to growing economic uncertainty. As a precaution, he advises investors to start shifting toward precious metals. However, rather than gold, Kiyosaki recommends silver.

As a safe-haven asset, precious metals are often seen as a hedge during economic uncertainty. Gold, for instance, has reached an all-time high due to soaring investor demand. However, Kiyosaki believes silver presents a better opportunity as it remains relatively undervalued compared to gold.

His perspective has also been analyzed by Michael Maharrey, the executive editor of SchiffGold and host of the Friday Gold Wrap Podcast. According to Maharrey, Kiyosaki predicts that the US dollar will eventually collapse when the Federal Reserve (The Fed) gives in to inflation and keeps interest rates high for an extended period.

Maharrey explains that over the past few months, gold and silver prices have been under pressure due to the belief that The Fed would successfully combat inflation and begin cutting interest rates. However, he argues that precious metals still hold strong potential, particularly after the Bank of England (BoE) reversed its monetary policy to save its pension system.

“In a recent interview with Charles Payne, Peter Schiff stated that The Fed will eventually follow the same path as BoE,” he said.

To capitalize on the potential decline of the US dollar, Kiyosaki has been increasing his silver holdings, forecasting that its price will surge to between US$100 and US$500 within this decade.

He also revealed that gold and silver dealers have told him that getting hold of gold or silver coins has become increasingly difficult, as the Mint refuses to sell more.

“The end of fake money is near. Stocks, bonds, mutual funds, ETFs, and real estate will collapse. Meanwhile, silver has remained at US$20 for the past 3–5 years and is set to surge between US$100 and US$500. Anyone can afford silver, even the poor,” Kiyosaki stated.

He urged investors to accumulate silver now while prices are still relatively low.

Kiyosaki also pointed out the gold-silver ratio, which currently stands at 86:1, meaning it takes 86 ounces of silver to purchase one ounce of gold. Historically, the modern average is between 40:1 and 50:1.

Each time this spread widens significantly, silver has outperformed gold in a short period. Since January 2000, this has happened four times.

“Why do I recommend buying silver? For just US$25, anyone can buy a silver coin. Don’t just take my word for it. Learn, get rich, don’t be foolish,” he said.

In an interview with Kitco News, Kiyosaki further emphasized that he prefers hard assets such as gold, silver, oil, and food over paper assets like stocks and bonds, which can be printed at will.

“Anything that can be printed, like stocks, bonds, or the dollar, I don’t want it. I am a fan of gold, silver, oil, and food. I am a holder of hard assets,” Kiyosaki affirmed.

Source: cnbcindonesia.com

What do you think about this topic? Tell us what you think. Don't forget to follow Digivestasi's Instagram, TikTok, Youtube accounts to keep you updated with the latest information about economics, finance, digital technology and digital asset investment.

DISCLAIMER

All information contained on our website is summarized from reliable sources and published in good faith and for the purpose of providing general information only. Any action taken by readers on information from this site is their own responsibility.