News Update

Jakarta Minimum Wage Rises to Rp 5.72 Million, Business Leaders Respond

/index.php

Crypto News - Posted on 21 December 2025 Reading time 5 minutes

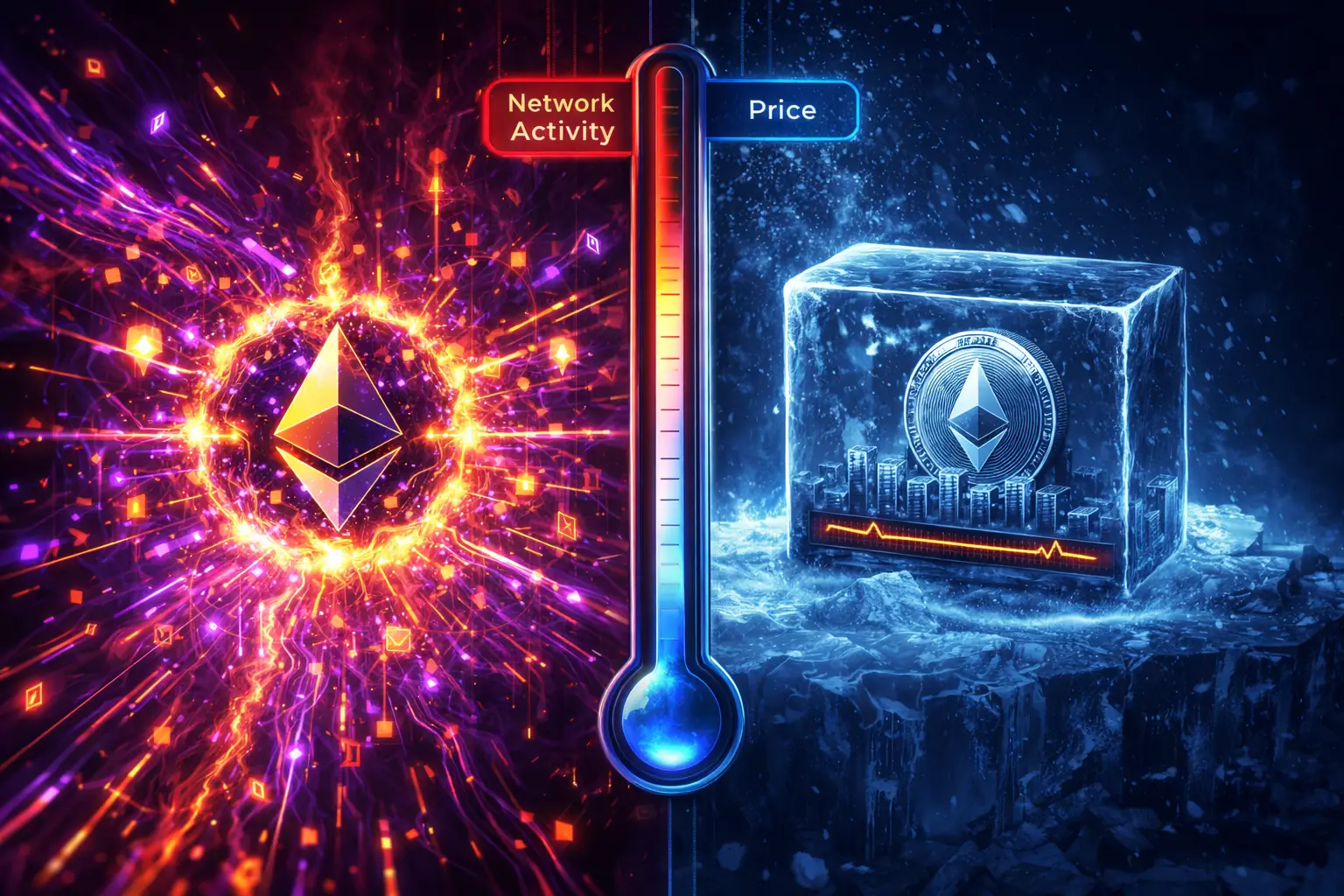

Ethereum Network Activity Surges in December, but ETH Price Remains Constrained

Activity on the Ethereum blockchain network recorded a significant increase throughout December, as reflected by a sharp rise in various on-chain indicators such as the number of active addresses and transaction volume. Nevertheless, the surge in network usage has not been fully mirrored by Ether (ETH) price movements, which have remained range-bound and below several key technical levels in recent weeks.

According to the latest on-chain data, Ethereum posted growth in both active addresses and transaction volume during December 2025. This increase indicates broader user participation and expanding utilization of the network for a wide range of purposes, including decentralized finance (DeFi) services, NFT trading, and cross-network value transfers. These conditions point to deeper adoption of Ethereum’s technology, even though the market has yet to respond with a commensurate rise in price.

Price Remains Under Pressure Despite Strengthening Fundamentals

On the price front, ETH continues to trade at levels that are relatively lower than its previous peaks. Several technical analysts note that Ethereum is still facing short-term price pressure and remains below key resistance zones in the US$3,000–US$3,300 range. This price behavior suggests that strengthening network fundamentals have not yet been sufficient to shift market sentiment in the near term.

This situation highlights an imbalance between the growth of on-chain activity and price performance in the spot market. While network usage continues to expand, market participants appear to remain cautious about ETH’s short-term outlook.

Key Drivers Behind the Surge in Network Activity

The increase in activity on the Ethereum network has been driven by several key factors, including a rise in the number of active addresses, which signals that more users are interacting with Ethereum-based applications. In addition, higher transaction volumes throughout December reflect broader usage of the network across the DeFi sector, NFT markets, and various value transfer use cases.

This growth reinforces Ethereum’s position as the world’s largest smart contract ecosystem, capable of processing hundreds of thousands of transactions and interactions on a daily basis. Elevated network activity is generally viewed as a sign of healthy fundamentals and serves as an important foundation for long-term growth.

Price Response Still Lags Behind

Despite the positive trend in on-chain metrics, ETH prices have yet to show a corresponding rally. Ether continues to trade below several key resistance levels, with intermittent selling pressure limiting upward momentum. The latest technical data indicate that ETH remains below the US$3,000 level, underscoring the gap between strong network fundamentals and the market’s price response.

Analysts note that this phenomenon is not unprecedented. In previous periods, Ethereum’s network indicators have reached elevated levels without being followed by significant price appreciation. This suggests that external factors—such as global macroeconomic conditions, market liquidity, and institutional investor behavior—continue to exert a strong influence on ETH’s short-term price movements.

Looking Ahead

Although price action has yet to reflect the growth of the network, many investors and developers continue to view rising on-chain activity as a core strength of Ethereum. Sustained increases in network usage are widely regarded as a critical foundation for long-term adoption and could eventually serve as a positive catalyst for price performance if market demand begins to catch up with the strength of underlying fundamentals.

What do you think about this topic? Tell us what you think. Don't forget to follow Digivestasi's Instagram, TikTok, Youtube accounts to keep you updated with the latest information about economics, finance, digital technology and digital asset investment.

DISCLAIMER

All information contained on our website is summarized from reliable sources and published in good faith and for the purpose of providing general information only. Any action taken by readers on information from this site is their own responsibility.