News Update

US - China Tensions Near Indonesia: Trump Deploys $1.5B Jets Against Xi Jinping!

/index.php

Bisnis | Ekonomi - Posted on 08 October 2025 Reading time 5 minutes

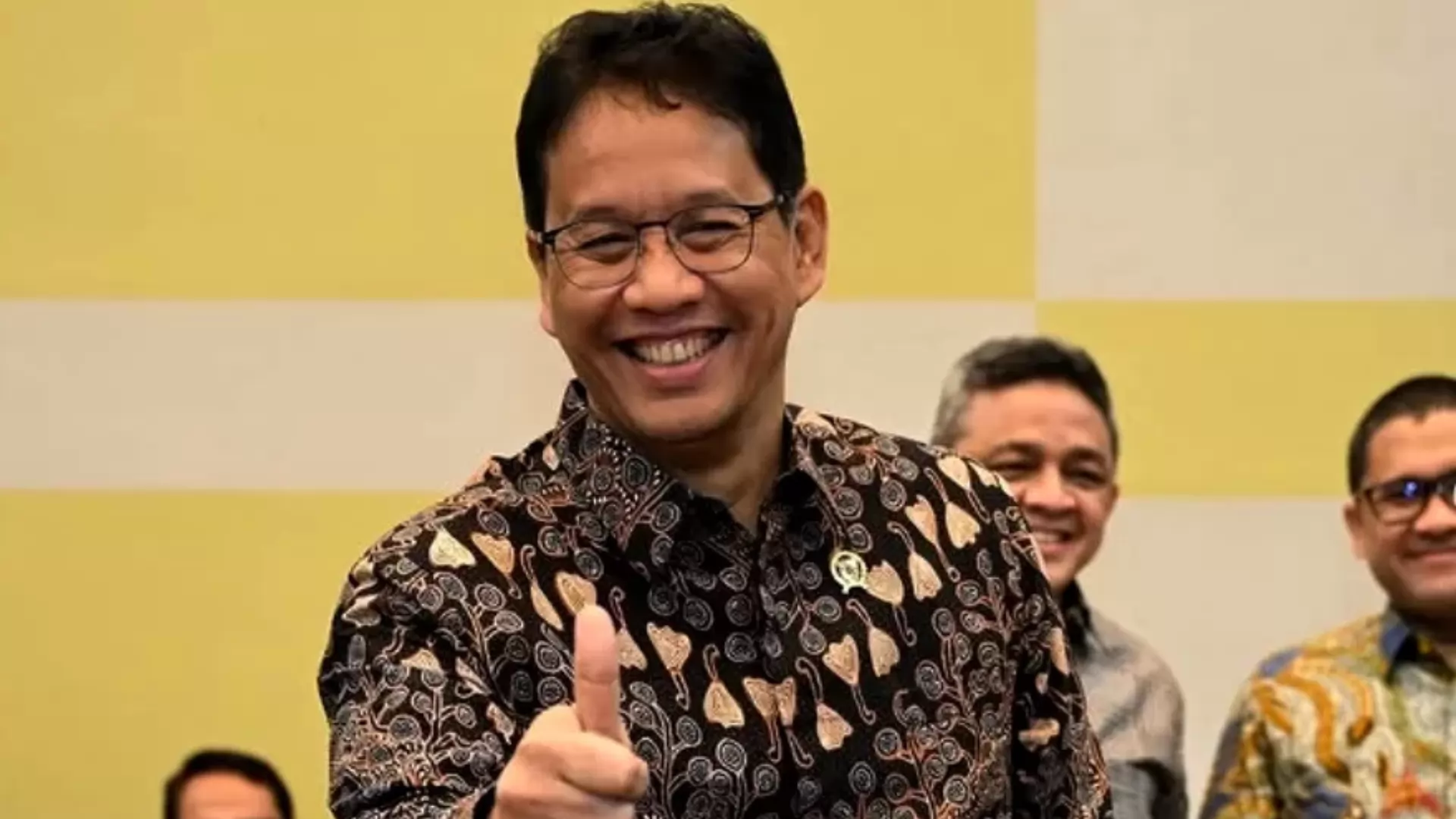

Purbaya Yudhi Sadewa has officially marked one month in office as Indonesia’s Minister of Finance, succeeding Sri Mulyani Indrawati as of October 8, 2025. He was inaugurated by President Prabowo Subianto as the 30th Finance Minister of Indonesia on September 8, 2025.

Since assuming the position, Purbaya has introduced a series of bold and groundbreaking policies. The most notable among them is his decision to relocate Rp200 trillion of idle government funds from Bank Indonesia (BI) to five state-owned banks on September 12, 2025.

This policy, formalized through Minister of Finance Decree (KMK) No. 276 of 2025, aims to boost the circulation of base money (M0) within the national financial system. The intention is to encourage banks to extend more credit to productive sectors, thereby accelerating economic growth.

“It’s only a matter of time before the entire economy begins to move faster,” said Purbaya during an interview at his office, as quoted on Wednesday (October 8, 2025).

In addition to this major initiative, Purbaya has also rolled out multiple complementary measures to speed up Indonesia’s economic performance, which has long hovered around 5% growth. He expressed confidence that the national economy could reach 6–8% growth in the near term, aligning with President Prabowo’s vision.

“Achieving 8% this year may be difficult, but within two or three years, it’s certainly possible,” Purbaya remarked at the Presidential Palace.

Below is the complete list of Purbaya Yudhi Sadewa’s key policy actions during his first month as Finance Minister:

Allocated Rp200 trillion to state-owned banks (Himbara) to boost liquidity, promote lending, and support economic expansion.

Decided not to raise tobacco excise taxes in 2026, helping the tobacco industry recover after three years of business pressure.

Brought in external experts to resolve issues in the Coretax system within one month.

Reclaimed unused ministry and agency budgets to redirect them toward President Prabowo’s priority programs.

Introduced tax relief measures, including government-borne income tax (PPh 21) for workers in labor-intensive industries earning up to Rp10 million.

Targeted 200 major tax delinquents, with total enforceable claims amounting to Rp50–60 trillion.

Cracked down on illegal cigarette distribution, both in small retail shops and online marketplaces.

Increased regional transfers by Rp43 trillion, bringing the total to Rp693 trillion in 2026.

Extended the 0.5% Final Income Tax incentive for MSMEs until 2026.

Fought against illegal textile imports from China, which have captured 99% of Indonesia’s apparel market, including Muslim fashion.

Expanded placement of idle government funds to Bank Jakarta and Bank Jatim to strengthen liquidity circulation.

Established a special industrial zone for tobacco products, enabling illegal cigarette producers to legalize their operations more easily.

Source: cnbcindonesia.com

What do you think about this topic? Tell us what you think. Don't forget to follow Digivestasi's Instagram, TikTok, Youtube accounts to keep you updated with the latest information about economics, finance, digital technology and digital asset investment.

DISCLAIMER

All information contained on our website is summarized from reliable sources and published in good faith and for the purpose of providing general information only. Any action taken by readers on information from this site is their own responsibility.