Bussiness | Economy

Dollar Nears Rp17,000! Purbaya Dismisses Fears of Indonesia's Economic Crisis

/index.php

Edukasi - Posted on 23 January 2026 Reading time 5 minutes

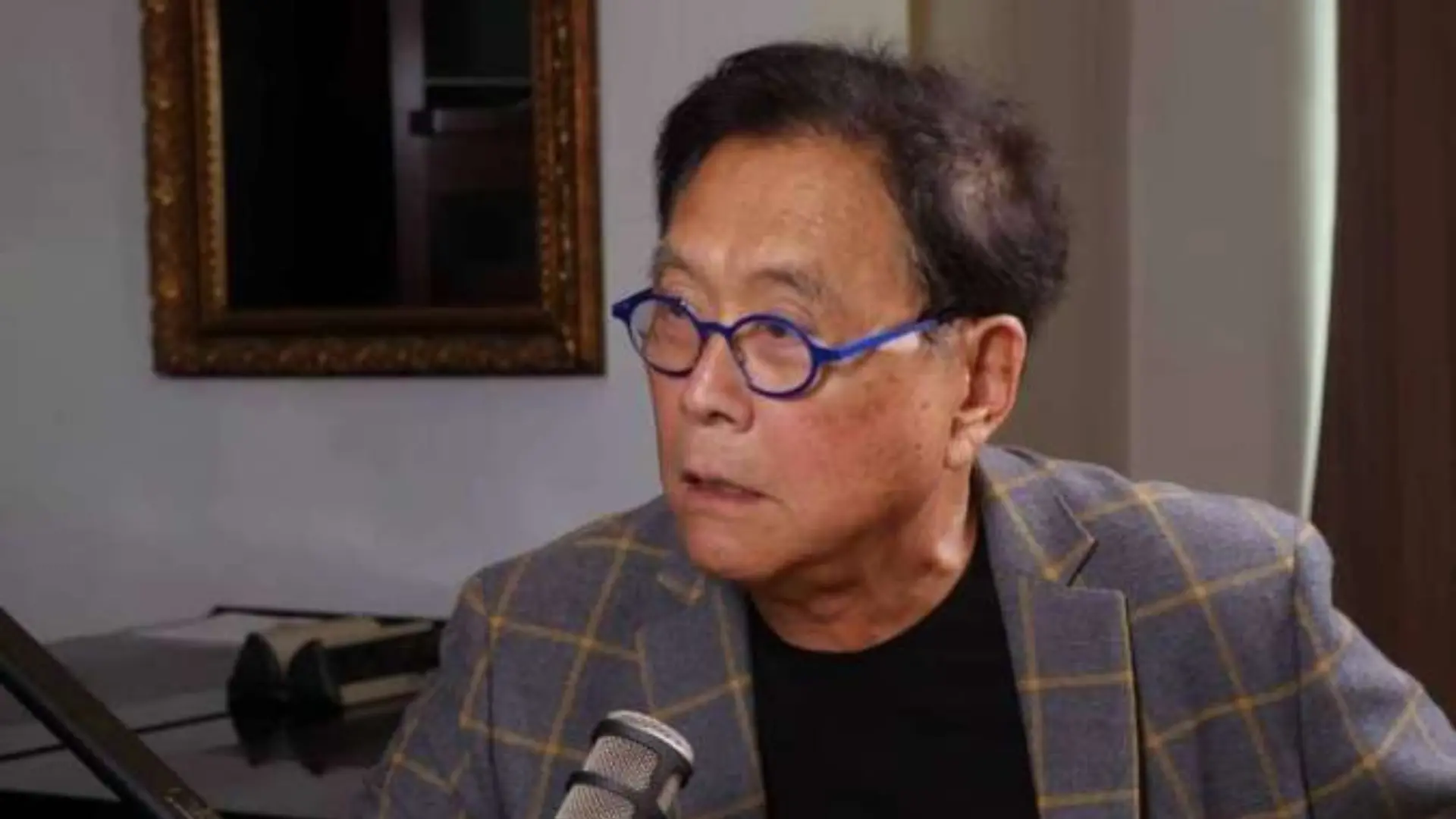

Rich Dad Poor Dad author Robert Kiyosaki has once again sparked controversy with his views on global market conditions. He claims that the best opportunity to build wealth is drawing closer, while simultaneously warning that the property market is collapsing and challenging times lie ahead.

According to Yahoo Finance, Kiyosaki previously wrote on platform X in July 2024 that a major wealth-building opportunity was approaching. However, he stressed that the danger had not passed, as market collapses do not happen overnight but unfold gradually over decades.

So far, global financial markets have shown resilience despite heightened volatility. The benchmark S&P 500 index rose more than 17% year-to-date through the end of December, reflecting a recovery following sharp fluctuations earlier in the year.

Kiyosaki, however, argues that such optimism is misleading, as he believes a major crisis is still in progress. In his latest post, he emphasized that market crashes are the result of long-term accumulation rather than sudden events.

In response to these conditions, Kiyosaki shared advice from the figure he refers to as Rich Dad, highlighting the importance of building passive income, or the ability to “make money while you sleep,” as a key pathway to wealth.

He also encouraged individuals to continuously improve their financial literacy by studying regularly, attending seminars, and learning from those who have already achieved success.

Kiyosaki’s warning of “hard times ahead” is rooted in his historical analysis of the monetary system. He argues that the current crisis traces back to 1913, when the U.S. Federal Reserve took control of the American monetary system.

According to him, a large-scale market collapse would be especially damaging for retail investors. He cited the late-2000s housing and global credit crisis, which wiped out approximately US$16 trillion in net household wealth in the United States.

Another example occurred during the 2022 stock market sell-off, which resulted in losses of around US$3 trillion for 401(k) and IRA retirement account holders. While not as severe as his forecast of the “greatest crash in history,” the figure highlights the magnitude of market turmoil.

Despite his pessimistic tone, Kiyosaki believes there will still be winners. He is convinced that investors who understand monetary history will benefit from rising prices of gold, silver, and cryptocurrencies such as Bitcoin and Ethereum when the fiat system weakens.

His optimism toward these assets stems from a deep distrust of the U.S. fiat currency. Kiyosaki describes the United States as the most indebted nation in history, arguing that this undermines confidence in fiat money.

He has also made highly aggressive price forecasts. Kiyosaki predicts silver could surpass US$100 per ounce by 2026 and potentially climb as high as US$200 per ounce.

His outlook for gold is even more extreme. He claims gold prices could reach US$27,000 per ounce, citing the views of economist Jim Rickards and his own ownership of two gold mines.

This year has been a standout period for precious metals. Silver prices surged more than 160% throughout 2025, while gold gained over 66%, making it the second-best performing asset.

With expectations of the rally extending into 2026, Kiyosaki encourages investors to view precious metals as long-term investments, potentially integrated into retirement planning to preserve financial stability.

At the same time, he also highlights Bitcoin’s potential despite its high risks. Kiyosaki warns of extreme volatility in the crypto market, including flash crash events that have erased hundreds of billions of dollars in market value within minutes.

Although widely known for his bold market predictions, Kiyosaki continues to stress the importance of caution. He advises investors to seek additional perspectives and fully understand the risks before entering new investment instruments.

Source: cnbcindonesia.com

What do you think about this topic? Tell us what you think. Don't forget to follow Digivestasi's Instagram, TikTok, Youtube accounts to keep you updated with the latest information about economics, finance, digital technology and digital asset investment.

DISCLAIMER

All information contained on our website is summarized from reliable sources and published in good faith and for the purpose of providing general information only. Any action taken by readers on information from this site is their own responsibility.