Education

25 Low - Capital Business Ideas Millennials & Gen Z Love in 2026

/index.php

Saham News - Posted on 20 January 2026 Reading time 5 minutes

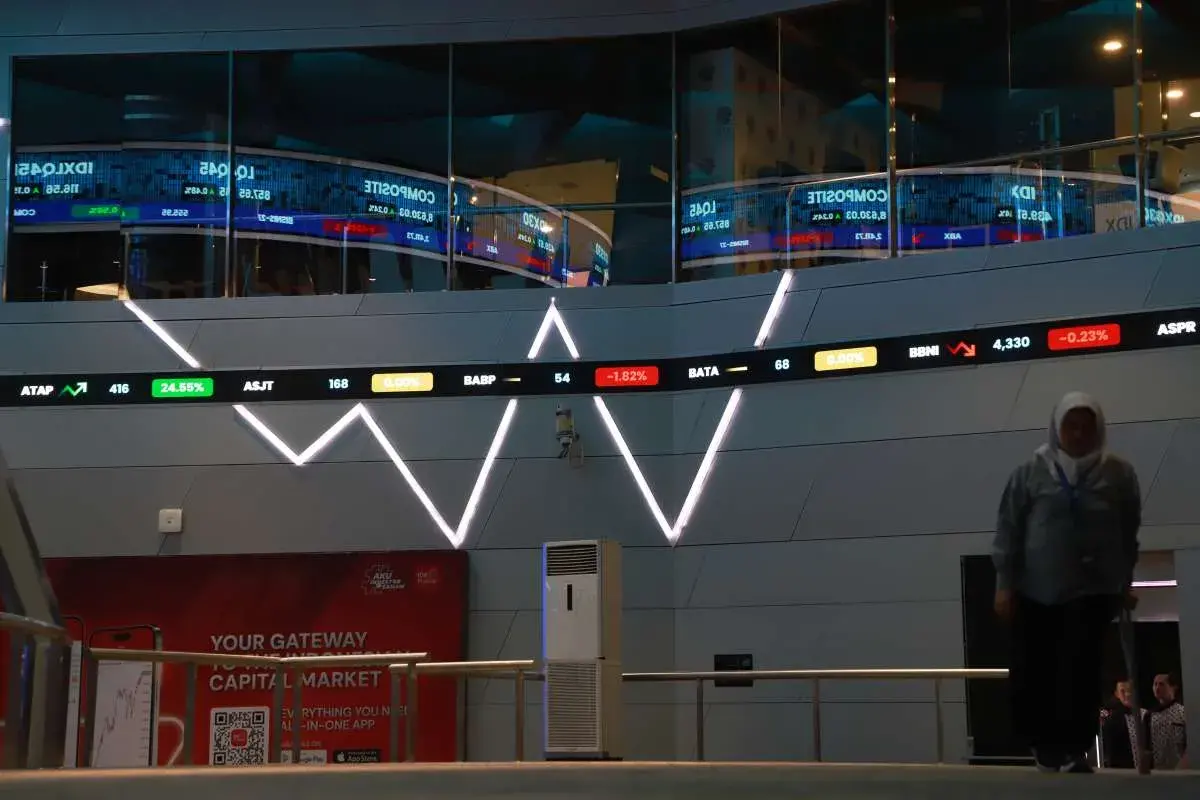

Phintraco Sekuritas forecasts that the Jakarta Composite Index (JCI) is likely to continue its upward movement this week. The index is expected to trade within a range defined by resistance at 9,200, a pivot level of 9,100, and support around 9,000.

In its analysis, Phintraco Sekuritas highlighted six selected stocks with potential profit opportunities, including BFIN.

The firm noted that major Wall Street indices closed lower on Friday (January 16, 2026) and ended the previous week in negative territory. The downturn was driven by ongoing uncertainty surrounding the Federal Reserve’s direction and heightened geopolitical risks.

US President Donald Trump signaled his intention to retain Kevin Hassett as an economic adviser rather than appointing him as the next Federal Reserve Chair, increasing the likelihood that Fed Governor Kevin Warsh could emerge as the leading candidate to succeed Jerome Powell.

According to Phintraco Sekuritas’ research, Trump also plans to impose tariffs on eight NATO member countries until an agreement on the purchase of Greenland is reached. The proposed tariffs are set at 10% starting February 1, 2026, and will rise to 25% beginning June 1, 2026.

Meanwhile, Wall Street trading will be closed today in observance of Martin Luther King Jr Day. Throughout the week, investors will focus on the ongoing earnings season and key US economic indicators, including the PCE Price Index and third-quarter 2025 GDP data. PMI figures from the Euro Area, the United Kingdom, and Japan are also scheduled for release.

In Asia, market participants will closely watch China’s fourth-quarter 2025 GDP figures and monetary policy decisions from the Bank of Japan. Additionally, China and Canada have reached a trade agreement to reduce tariffs on certain products starting March 1, 2026.

On the domestic front, investors are awaiting Bank Indonesia’s Board of Governors meeting on January 20–21, which is widely expected to keep the benchmark interest rate unchanged at 4.75% amid continued weakness in the rupiah. Credit growth data for December 2025 is also anticipated to slow to 7.6% year-on-year, down from 7.74%.

From a technical perspective, MACD and Stochastic RSI indicators suggest further upside potential for the JCI, opening room for the index to test the 9,100–9,200 range this week. Phintraco Sekuritas’ stock recommendations include BFIN, ISAT, CDIA, MAPI, TLKM, and SIDO.

Source: investor.id

What do you think about this topic? Tell us what you think. Don't forget to follow Digivestasi's Instagram, TikTok, Youtube accounts to keep you updated with the latest information about economics, finance, digital technology and digital asset investment.

DISCLAIMER

All information contained on our website is summarized from reliable sources and published in good faith and for the purpose of providing general information only. Any action taken by readers on information from this site is their own responsibility.