News Update

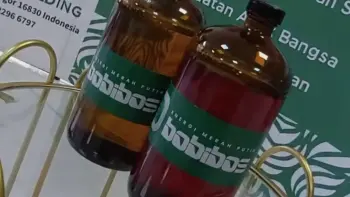

Viral Bobibos Fuel Hasn't Received ESDM Approval Yet - What's Going On?

/index.php

Crypto News - Posted on 09 November 2025 Reading time 5 minutes

Chainlink Adds 78,250 LINK to Reserves: A Sign of Accumulation or a Long-Term Technical Strategy?

The decentralized oracle network Chainlink (LINK) has once again drawn market attention after adding 78,250 LINK tokens, worth approximately US$1.1 million, to its Reserve account. This move has sparked speculation among crypto analysts over whether it signals institutional accumulation or is merely part of a routine technical strategy amid the token’s price weakness.

According to a report from AMBCrypto, the reserve increase occurred within a one-week period, bringing Chainlink’s total Reserve balance to 729,338 LINK, valued at around US$10.8 million, with an average entry price of US$20.49 per token.

This development is linked to the growing activity in Real World Asset (RWA) tokenization, which leverages Chainlink’s infrastructure. Furthermore, the network continues to gain adoption from institutions and financial service platforms, including Securitize, which utilizes Chainlink’s on-chain NAV reporting and data standards.

The sizable addition to reserves is viewed by analysts as a sign that Chainlink’s network operators or affiliated entities are strengthening long-term liquidity positions. This could potentially reduce short-term selling pressure and reflect confidence in the project’s fundamental outlook.

While this accumulation appears promising, analysts caution that price appreciation may not occur immediately. The effectiveness of Chainlink’s long-term strategy still depends on ecosystem adoption, staking volume, and the network’s utility in the digital asset tokenization sector.

Large Reserves Do Not Guarantee a Price Surge

The expansion of Chainlink’s reserves underscores the project’s long-term approach to ecosystem stability, rather than serving as a direct signal of imminent price increases. Alongside reserves, other factors such as token outflows from exchanges, staking participation, and demand for network utility continue to shape the circulating supply dynamics of LINK. The crypto market remains in a high-volatility phase, where shifts in global sentiment and monetary policy decisions can swiftly influence medium-term price trajectories.

What do you think about this topic? Tell us what you think. Don't forget to follow Digivestasi's Instagram, TikTok, Youtube accounts to keep you updated with the latest information about economics, finance, digital technology and digital asset investment.

DISCLAIMER

All information contained on our website is summarized from reliable sources and published in good faith and for the purpose of providing general information only. Any action taken by readers on information from this site is their own responsibility.