News Update

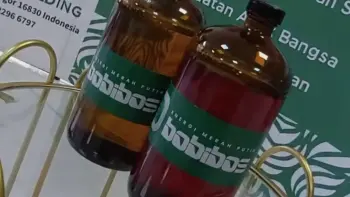

Viral Bobibos Fuel Hasn't Received ESDM Approval Yet - What's Going On?

/index.php

Crypto News - Posted on 09 November 2025 Reading time 5 minutes

Japan’s Three Banking Giants Unite to Launch Yen-Pegged Stablecoin: A Milestone in the Nation’s Digital Payment Era

Japan’s three largest financial institutions, Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Banking Corporation (SMBC), and Mizuho Financial Group have officially announced a strategic collaboration to launch a yen-pegged stablecoin (JPY). This monumental initiative is expected to serve as a cornerstone for building a blockchain-based national digital payment ecosystem, marking a new chapter in Japan’s financial transformation.

Revolutionizing Japan’s Payment System

The collaboration among the three banking giants will focus on issuing a stablecoin fully backed by cash reserves held in licensed financial institutions, maintaining a 1:1 ratio with the Japanese yen. The initiative aligns with the recent amendments to Japan’s Payment Services Act, which now formally authorizes banks to issue stablecoins. The yen-based stablecoin will operate on Progmat Coin, an interoperable blockchain platform developed by MUFG’s subsidiary. This infrastructure is designed to enable fast, low-cost, and compliant cross-platform transactions while adhering to Japan’s stringent banking security and regulatory standards.

A Concrete Step Toward Japan’s Digital Economy

According to a 2025 report by CoinDesk Japan, this partnership is viewed as a key pillar of the Japanese government’s efforts to accelerate the digitalization of its national payment system. Beyond serving as a digital payment instrument, the yen stablecoin is also expected to play a vital role in developing a tokenized economy, including potential integration with the Central Bank Digital Currency (CBDC) project currently under review by the Bank of Japan (BoJ).

With direct backing from Japan’s three largest financial institutions, the yen stablecoin is planned to be integrated across multiple economic sectors ranging from e-commerce and cross-border remittances to corporate transaction settlements. This infrastructure is also anticipated to lay the groundwork for Web3 and DeFi ecosystem development in the East Asian region.

Global Impact and Implications for the Crypto Industry

Japan’s move has drawn global attention, as it represents one of the most extensive collaborations between traditional banking and blockchain technology to date.

Unlike privately issued stablecoins such as USDT (Tether) or USDC (Circle), the yen stablecoin will be fully backed by banking institutions and regulated by the government, establishing a new precedent for integrating digital assets within the formal financial system.

The launch of the yen stablecoin by MUFG, SMBC, and Mizuho marks a historic milestone in the evolution of Japan’s financial system.

Supported by a robust regulatory framework and advanced blockchain technology, this project has the potential to become a global benchmark for stability, transparency, and efficiency in digital transactions.

What do you think about this topic? Tell us what you think. Don't forget to follow Digivestasi's Instagram, TikTok, Youtube accounts to keep you updated with the latest information about economics, finance, digital technology and digital asset investment.

DISCLAIMER

All information contained on our website is summarized from reliable sources and published in good faith and for the purpose of providing general information only. Any action taken by readers on information from this site is their own responsibility.