News Update

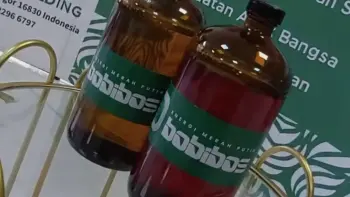

Viral Bobibos Fuel Hasn't Received ESDM Approval Yet - What's Going On?

/index.php

Crypto News - Posted on 09 November 2025 Reading time 5 minutes

Tether Adds US$1 Billion Worth of Bitcoin to Its Reserves Amid a Weak Market: Strategic Move or the Start of a New Bubble?

Tether (USDT), the world’s largest stablecoin issuer, has once again drawn the attention of the crypto market after officially announcing the purchase of approximately 8,888 BTC, valued at nearly US$1 billion, at the end of the third quarter of 2025. This large-scale acquisition comes amid a period of price consolidation, with Bitcoin (BTC) still trading at relatively low levels following the recent market correction.

Details of the Transaction

According to on-chain data, a total of 8,888.889 BTC was transferred from Bitfinex’s hot wallet to Tether’s reserve address on September 30, 2025.

The company confirmed that this purchase is part of its asset reserve diversification strategy, initiated in 2023, under which Tether allocates up to 15% of its quarterly net profits to acquire Bitcoin on a regular basis.

Tether CEO Paolo Ardoino emphasized that Bitcoin is now viewed as the company’s “ultimate reserve asset.”

He also clarified that the purchase did not involve USDT customer funds, but was instead financed entirely from Tether’s operational profits.

Analysts suggest that the timing of the purchase is not coincidental, citing several factors behind Tether’s decision:

The current weak Bitcoin price offers a strategic accumulation opportunity for large institutional players.

The move reinforces Tether’s position as the world’s leading stablecoin issuer, while signaling its long-term confidence in the crypto asset market.

It represents a diversification of reserve holdings, shifting from a heavy reliance on U.S. government bonds and cash toward assets considered hedges against inflation.

Tether’s move carries several positive implications for the crypto industry:

It sends a strong signal that major entities now view Bitcoin as a fundamental reserve asset, not merely a speculative instrument.

It strengthens Tether’s image and credibility as a stablecoin issuer with a more diversified and structured asset reserve strategy.

However, this decision also entails notable risks.

If Bitcoin’s price continues to decline, Tether could face substantial mark-to-market losses, given the scale of its accumulation. Moreover, some analysts warn of a potential new speculative bubble driven by such large institutional purchases. Crypto analyst Jacob King even described Tether’s move as “one of the biggest potential bubble catalysts in Bitcoin’s history.”

Regulatory Scrutiny and Systemic Risk

As regulators increasingly focus on the stability of the stablecoin-based financial system, Tether’s Bitcoin accumulation may invite closer scrutiny. Global financial authorities could question the extent to which high-volatility assets like Bitcoin might affect the future stability of USDT reserves.

Tether’s US$1 billion Bitcoin purchase is not merely an investment maneuver but a strategic statement about the company’s position in the global digital asset ecosystem.

The move underscores Tether’s conviction that Bitcoin serves as a foundational pillar in the decentralized financial system.

What do you think about this topic? Tell us what you think. Don't forget to follow Digivestasi's Instagram, TikTok, Youtube accounts to keep you updated with the latest information about economics, finance, digital technology and digital asset investment.

DISCLAIMER

All information contained on our website is summarized from reliable sources and published in good faith and for the purpose of providing general information only. Any action taken by readers on information from this site is their own responsibility.