News Update

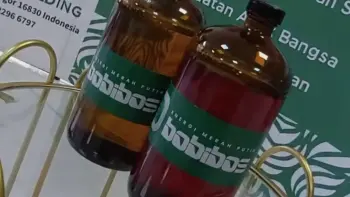

Viral Bobibos Fuel Hasn't Received ESDM Approval Yet - What's Going On?

/index.php

Bisnis | Ekonomi - Posted on 09 November 2025 Reading time 5 minutes

The plan to implement the redenomination of the Indonesian rupiah, or the simplification of currency denominations, has resurfaced once again. This time, it is being initiated by Minister of Finance Purbaya Yudhi Sadewa through Ministerial Regulation (PMK) No. 70 of 2025.

Under this regulation, Purbaya aims to complete the regulatory framework for redenomination through the Draft Law on the Change of Rupiah Value (Redenomination) by 2026–2027.

As is widely known, the Redenomination Bill was first proposed by the government and Bank Indonesia (BI) to the House of Representatives (DPR) back in 2013, but has not been realized to this day.

“The Draft Law on the Change of Rupiah Value (Redenomination) is a continuation bill that is planned for completion by 2027,” reads PMK No. 70/2025, signed by Minister Purbaya Yudhi Sadewa on October 10, 2025, and enacted on November 3, 2025.

One of Purbaya’s main reasons for pursuing redenomination is economic efficiency, as outlined in the urgency section of PMK 70/2025.

According to the 2017 Indonesia Treasury Review titled Strategic Design and Readiness Assessment of Redenomination in Indonesia, the policy is intended to simplify currency denominations to make transactions and accounting records more practical.

The Journal of Treasury, State Finance, and Public Policy explains that large-digit values in rupiah often cause complications for large-scale businesses, particularly in accounting software and banking IT systems, which face technical issues when processing figures exceeding Rp10 trillion.

The issue of excessive zeros even led advocate Zico Leonard Djagardo Simanjuntak to file a judicial review of Article 5 paragraphs (1)(C) and (2)(C) of Law No. 7 of 2011 on Currency to the Constitutional Court (MK) in May 2025.

Zico argued that the excessive zeros in rupiah make the currency inefficient, noting that many countries that have reduced zeros in their currencies are often seen as having strong, stable economies.

He also recalled a redenomination plan proposed by Darmin Nasution, who served as Governor of Bank Indonesia from 2010 to 2013. In 2010, Darmin stated that redenomination was a national necessity.

“According to Darmin, Indonesia needs redenomination to face future challenges, particularly the regional economic integration,” Zico wrote in his petition to the Constitutional Court.

Zico further highlighted that habitually dealing with large denominations can lead to nearsightedness and eye strain, caused by visual fatigue from reading too many zeros.

He emphasized that too many zeros create unnecessary complexity in financial transactions. For businesses, he argued, redenomination would simplify financial operations, shorten processing time, and reduce human error.

Furthermore, redenomination could help cut costs associated with hardware and software upgrades in accounting and IT systems.

He also pointed out that large currency denominations create economic inefficiencies by increasing both transaction time and costs, making cash transactions less convenient.

In his report, Zico urged that redenomination be implemented to improve public and international perception of the Indonesian rupiah.

However, the Constitutional Court ultimately rejected his petition, ruling that redenomination policy falls under the authority of lawmakers (DPR), not through judicial review petitions.

Nevertheless, the ruling did not close the door on redenomination, as the justices emphasized that the policy can still proceed through legislative deliberation between the government and the DPR.

In a Bank Indonesia press release from August 2010, BI clarified that redenomination is not the same as “sanering”, meaning it does not reduce purchasing power. Instead, it merely simplifies the writing of currency values and prices, improving efficiency in payment systems without harming the economy.

In 2010, BI had already drafted a five-phase redenomination plan.

The first phase involved benchmark studies in other countries.

The second phase (2011–2012) was the public outreach stage.

The third phase (2013–2015) introduced dual-currency quotations.

The fourth phase (2016–2018) aimed to withdraw old banknotes.

The final phase (2019–2020) marked full implementation of the redenominated rupiah.

Unfortunately, the plan was never executed, as the Redenomination Bill was never formally discussed, even though it appeared in the Ministry of Finance’s strategic plans, including during Sri Mulyani Indrawati’s 2020–2024 term.

Through redenomination, the rupiah’s value would be simplified without changing its real exchange rate or purchasing power, by removing three zeros.

For instance, banknotes currently valued at Rp100,000 would become Rp100, Rp50,000 would become Rp50, Rp20,000 would become Rp20, Rp10,000 would become Rp10, Rp2,000 would become Rp2, and Rp1,000 would become Rp1.

In his early studies, former BI Governor Darmin Nasution stated that removing three zeros would also reintroduce the use of coins denominated in “sen”, meaning Rp500 would become 5 sen, Rp200 would become 2 sen, and Rp100 would become 1 sen.

Source: cnnindonesia.com

What do you think about this topic? Tell us what you think. Don't forget to follow Digivestasi's Instagram, TikTok, Youtube accounts to keep you updated with the latest information about economics, finance, digital technology and digital asset investment.

DISCLAIMER

All information contained on our website is summarized from reliable sources and published in good faith and for the purpose of providing general information only. Any action taken by readers on information from this site is their own responsibility.