News Update

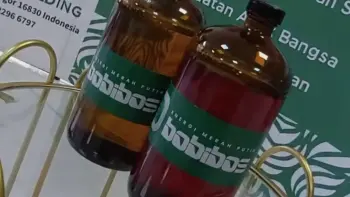

Viral Bobibos Fuel Hasn't Received ESDM Approval Yet - What's Going On?

/index.php

Crypto News - Posted on 09 November 2025 Reading time 5 minutes

Stephen Miran: Stablecoin Adoption Could Lower Interest Rates, Creating New Challenges for U.S. Monetary Policy

Federal Reserve Governor Stephen Miran believes that widespread adoption of stablecoins could potentially lower long-term benchmark interest rates in the United States. According to him, the growing use of stablecoins may increase the overall supply of loanable funds in the economy, which in turn could push down the neutral interest rate (r-star). Miran delivered this statement during his speech at the BCVC Summit 2025 in New York, as reported by Reuters and the official Federal Reserve website.

Stablecoins and Their Relationship with R-Star

Miran explained that stablecoins not only function as digital payment instruments but also strengthen global demand for U.S. dollar–denominated assets and U.S. Treasuries. This phenomenon, he noted, indicates that stablecoins have become an alternative financial channel for individuals in countries with less stable currencies.

For context, r-star or the neutral interest rate is the short-term rate that neither accelerates nor slows economic activity. It serves as a critical reference point for central bank monetary policy.

Capital inflows from stablecoin users particularly those outside the traditional U.S. banking system expand the pool of funds available for lending. This situation exerts downward pressure on r-star and, consequently, on market interest rates.

The expansion of stablecoins also drives higher global demand for dollar-based assets, including short-term U.S. government securities, thereby lowering the borrowing costs (yields) for the government.

According to Miran’s estimates, the net effect of stablecoin adoption could reduce r-star by approximately 40 basis points (0.40%), assuming growth continues in line with projections.

However, despite his optimistic outlook, Miran also emphasized several key limitations of this potential impact:

If stablecoin adoption primarily involves shifting existing domestic bank deposits, the net increase in loanable funds would be minimal, resulting in limited downward pressure on r-star.

The global economic influence of stablecoins largely depends on regulatory clarity, infrastructure readiness, and cross-border acceptance. Without a clear legal framework and institutional support, their impact on lowering interest rates could be smaller than expected.

Miran’s perspective reflects a significant paradigm shift that stablecoins are no longer merely crypto instruments, but a new variable in modern monetary policy. If their adoption continues to rise, a low-interest-rate era in the U.S. may not stem solely from Federal Reserve policy, but also from the expanding role of digital assets in enhancing global liquidity.

What do you think about this topic? Tell us what you think. Don't forget to follow Digivestasi's Instagram, TikTok, Youtube accounts to keep you updated with the latest information about economics, finance, digital technology and digital asset investment.

DISCLAIMER

All information contained on our website is summarized from reliable sources and published in good faith and for the purpose of providing general information only. Any action taken by readers on information from this site is their own responsibility.