Bussiness | Economy

Indonesia to Distribute $420M Social Aid in Rice & Cooking Oil This October - November!

/index.php

Crypto News - Posted on 14 May 2024 Reading time 5 minutes

DIGIVESTASI - The cryptocurrency market still tends to stagnate after the halving that occurred in April last year. Some market participants are concerned that cryptocurrencies, including bitcoin, will face major challenges and struggle to make progress this year. According to Refinitiv, after the halving that took place on April 20, 2024, about three weeks ago, the price of bitcoin is still consolidating between $57,000 and $67,000.

The current sentiment is still choppy and nothing has been able to cause Bitcoin to experience a significant surge to break the psychological level of US$70,000 which was last touched on April 11, 2024.

1. High Fed interest rates

The US central bank, the Fed, currently has a benchmark interest rate of between 5.25 and 5.5% and has no plans to lower interest rates in the near future.

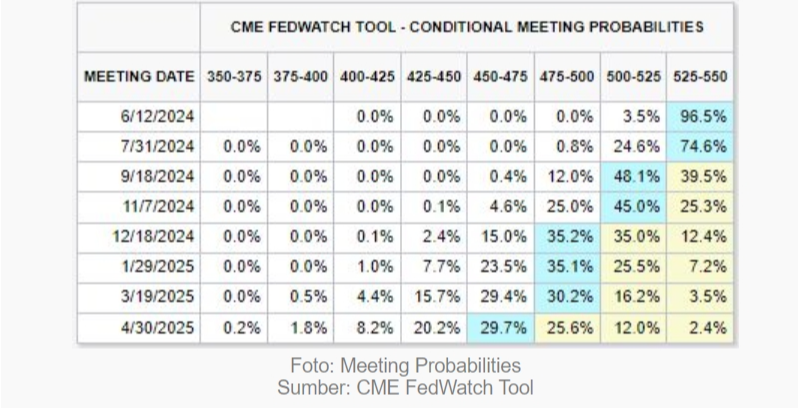

According to the CME FedWatch Tool survey, the first rate cut could come in September and the next in December 2024 with a total rate cut of 50 basis points (bps).

Fed officials have no plans to lower interest rates as US economic data shows no signs of a slowdown. In fact, US inflation increased from 3.2% (y/y) in February to 3.5% y/y in March 2024.

Similarly, core inflation was higher than the consensus forecast of 3.7% year-on-year. But in reality, in March 2024 it will reach 3.8% year-on-year, the same as last month.

Long-term high Fed rates (high for longer periods of time) will put pressure on riskier assets, including cryptocurrencies, as they tend to be safer havens (higher equities) will become more attractive with high yields. For example, the yield on 10-year US Treasury bonds remains high at 4.48% as of May 13, 2024.

2. Rejection of cryptocurrencies in various countries

Despite the benefits of bitcoin, some countries around the world are wary of its high volatility and decentralized nature and have chosen to reject it. Some also see it as a threat to their current monetary systems.

In addition, they are also concerned about its use to support illegal activities such as drug trafficking, money laundering, and terrorism. The Qatar Central Bank has banned the trading of cryptocurrencies such as bitcoin. Maha Al-, director of regulatory affairs at Qatar Central Financial Authority, commented: “The reason behind this was mainly to ensure consumer protection, because at the time there were no regulations governing it. Some people said it was because of its speculative nature.” Saadi, as quoted by cointelegraph com.

In early 2020, a report published by the Qatar Financial Center Regulatory Authority (QFCRA) marked a significant change in the country's approach to cryptocurrencies, declaring a ban on all cryptocurrency-related activities in Qatar's financial center, a key economic zone. Not only Qatar, but Saudi Arabia also tends to reject cryptocurrencies.

In 2018, the government banned banks from engaging in cryptocurrency trading. Authorities have repeatedly said that cryptocurrency traders are not financially protected and may be at risk when investing.

Currently, there are no recognized legal consequences for anyone who chooses to interact with digital assets in any form. Additionally, the Saudi Arabian Monetary Authority (SAMA) is at the forefront of monitoring cryptocurrency transactions, focusing on a regulatory environment that protects investors while promoting financial stability. SAMA strives to strike a balance between prudence and innovation.

If more and more countries reject cryptocurrencies, either for continued adoption or simply for trading, this will put pressure on cryptocurrencies, including bitcoin.

3. Miner rewards continue to decline

After the halving that took place last month, miners faced high network hash rates and lower earnings, Bitcoin miners may face a tough few months as the market adjusts to this quadrennial event. Bitcoin miner rewards range from 6.25 BTC per block to 3.125 BTC per block.

The low rewards miners receive will be a challenge, as miners will have to recalculate whether or not, with the equipment they currently have and the amount of electricity required to do the mining, it is still worth it.

It is not impossible, especially for small retail miners, that it will become increasingly difficult to make a profit until they stop mining altogether. One of Bitwise's recent studies, cited in the Economic Times, showed that miners' total revenue has decreased in the month following the previous three halvings. But this number has increased significantly over the year thanks to the soaring bitcoin price as well as the expansion of operations by large mining companies.

Time will tell how miners perform after the next halving. If there are fewer Bitcoin miners, it will disrupt the operations and security of the Bitcoin network itself. Without miners, the critical process of validating and adding new transactions to the blockchain will grind to a halt.

This outage will have a direct impact on the network's ability to process transactions, bringing bitcoin transactions and transfers to a halt.

Find more news and articles on Google News

Source: cnbcindonesia.com

What do you think about this topic? Tell us what you think. Don't forget to follow Digivestasi's Instagram, TikTok, Youtube accounts to keep you updated with the latest information about economics, finance, digital technology and digital asset investment.

DISCLAIMER

All information contained on our website is summarized from reliable sources and published in good faith and for the purpose of providing general information only. Any action taken by readers on information from this site is their own responsibility.