News Update

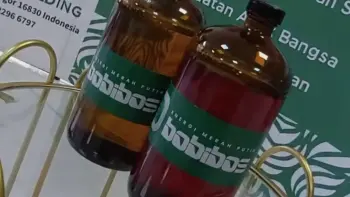

Viral Bobibos Fuel Hasn't Received ESDM Approval Yet - What's Going On?

/index.php

Crypto News - Posted on 11 July 2025 Reading time 5 minutes

Elon Musk has once again made headlines as a public figure capable of shaking the crypto market with a single post. The CEO of Tesla and SpaceX consistently demonstrates his outsized influence on the prices of digital assets such as Bitcoin, Dogecoin, and Ethereum, particularly through his activity on the social media platform X (formerly Twitter).

So, what makes Musk capable of creating such intense volatility in the global crypto market? Is it purely the power of personal branding, or is there a more complex market dynamic at play?

As one of the most influential figures in technology and digital pop culture, every comment Musk makes about crypto—whether as a joke or a business decision—tends to have a significant impact. The crypto market, still largely driven by retail investors, remains highly susceptible to public figures' opinions.

This phenomenon is known in market psychology as “herding behavior,” where investors tend to follow the majority without conducting thorough analysis. In this context, Elon Musk serves as a key catalyst for the emergence of both Fear of Missing Out (FOMO) and panic selling.

May 2021: Musk announced that Tesla would stop accepting Bitcoin as payment due to environmental concerns. Bitcoin's price fell more than 10% within hours.

2022–2024: Repeatedly calling Dogecoin the "currency of the future," Musk triggered several price spikes, driving DOGE up by more than 50% in a short time.

July 2025: Musk replaced the X platform logo with the Dogecoin icon for 24 hours, causing Dogecoin’s daily trading volume to surge to US$3 billion, according to CoinMarketCap data.

Unlike the stock market, which is mature and strictly regulated, the crypto market remains speculative and lacks global regulatory clarity. This makes digital asset prices highly sensitive to external factors, including public figure commentary.

Additionally, crypto communities active on platforms like Reddit, Telegram, and X quickly respond to breaking news, accelerating market reactions within seconds.

Some analysts argue that, although Musk’s influence has broadened crypto adoption, the market's dependency on a single individual highlights its ongoing instability.

The July 2025 Glassnode Weekly Report noted that price fluctuations driven by Musk’s sentiment often create opportunities for institutional investors, who take advantage of panic selling to accumulate assets at lower prices.

Elon Musk’s impact on the crypto market stems from a combination of his personal influence, the power of social media, and the crypto market’s immaturity. As long as the market remains dominated by retail investors and lacks comprehensive regulation, figures like Musk will continue to move the prices of Bitcoin, Dogecoin, and other digital assets.

Even so, investors are advised not to follow short-term sentiment blindly. Wise investment decisions still require fundamental analysis and an understanding of long-term market trends.

What do you think about this topic? Tell us what you think. Don't forget to follow Digivestasi's Instagram, TikTok, Youtube accounts to keep you updated with the latest information about economics, finance, digital technology and digital asset investment.

DISCLAIMER

All information contained on our website is summarized from reliable sources and published in good faith and for the purpose of providing general information only. Any action taken by readers on information from this site is their own responsibility.