News Update

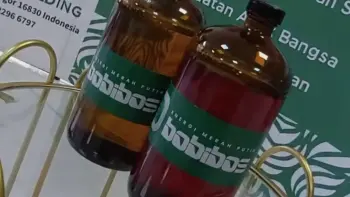

Viral Bobibos Fuel Hasn't Received ESDM Approval Yet - What's Going On?

/index.php

Crypto News - Posted on 06 November 2025 Reading time 5 minutes

A recent analysis from CryptoQuant revealed that Bitcoin (BTC) prices could continue to decline, potentially falling to around US$72,000 within the next one to two months if the cryptocurrency fails to hold the psychological level of US$100,000.

According to a report by The Block on Tuesday (November 4, 2025), Julio Moreno, Head of Research at CryptoQuant, explained that selling pressure continues to dominate the crypto market following the massive liquidation event on October 10, one of the largest in the history of the digital asset market.

“If the price fails to stay around the US$100,000 level and breaks downward again, the risk of a correction toward US$72,000 within one to two months will increase significantly,” said Moreno.

On Wednesday (November 5, 2025), Bitcoin briefly fell below US$100,000 for the first time since June before slightly rebounding and trading around US$101,000 at the time of writing. This correction also dragged down the broader crypto market, with global market capitalization dropping by approximately 3% to US$3.38 trillion.

Moreno further stated that this downward trend reflects a decline in spot demand for Bitcoin since the major liquidation event.

“Since then, spot Bitcoin demand has continued to shrink. In the United States, investor interest has also weakened, as reflected in negative ETF outflows and negative price premiums on Coinbase,” he explained.

He also noted that the CryptoQuant Bull Score Index currently stands at 20, indicating that the market remains in an extreme bearish zone since early October.

Bitcoin’s price drop is also being driven by rising global macroeconomic concerns, particularly regarding the direction of interest rate policy and the overall U.S. economic outlook.

According to Gerry O’Shea, Head of Global Market Insights at Hashdex, several factors—such as the potential delay in interest rate cuts by the Federal Reserve (The Fed), concerns over trade tariffs, and conditions in the credit market and equity valuations—have all worsened risk sentiment across both crypto and traditional assets.

“Bitcoin has also been affected by selling from long-term holders, which is a natural phenomenon as the asset matures and prices rise over time,” said O’Shea.

Although the US$100,000 level is viewed as a key psychological threshold, O’Shea emphasized that the recent pullback does not change Bitcoin’s long-term outlook.

“ETF inflows and institutional adoption remain strong. Many traditional financial institutions continue to build digital asset infrastructure and products,” he explained.

He further added that structural factors, such as a potential increase in global liquidity following the end of the Federal Reserve’s quantitative tightening (QT) policy, could serve as a positive catalyst for Bitcoin.

“The combination of these factors supports our view that Bitcoin still has the potential to reach new all-time highs in the coming months,” O’Shea concluded.

Source: coinvestasi.com

What do you think about this topic? Tell us what you think. Don't forget to follow Digivestasi's Instagram, TikTok, Youtube accounts to keep you updated with the latest information about economics, finance, digital technology and digital asset investment.

DISCLAIMER

All information contained on our website is summarized from reliable sources and published in good faith and for the purpose of providing general information only. Any action taken by readers on information from this site is their own responsibility.