News Update

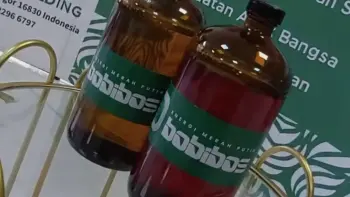

Viral Bobibos Fuel Hasn't Received ESDM Approval Yet - What's Going On?

/index.php

Edukasi - Posted on 11 July 2025 Reading time 5 minutes

Amid the high risks and volatility of the crypto market, the success story of an early Ethereum (ETH) investor stands as undeniable proof that taking bold opportunities early on can yield extraordinary returns. An investor who initially invested just US$100 during Ethereum’s launch in 2015 is now estimated to have amassed a fortune worth millions of U.S. dollars.

Ethereum was officially introduced to the public through a crowdsale in mid-2014, where the price of ETH ranged between US$0.30 and US$0.35 per coin. With a US$100 investment, this investor would have acquired between 285 and 333 ETH, depending on the exact purchase price.

As Ethereum’s price surged to an all-time high of around US$4,800 in November 2021, the investor’s holdings would have been valued at over US$1.3 million. Even with ETH trading between US$3,000 and US$3,500 as of July 2025, the investor’s portfolio remains worth several million dollars, demonstrating the tremendous growth potential of digital assets in less than a decade.

According to a 2023 CoinTelegraph report, analysts regard Ethereum as one of the best-performing assets in global financial market history, with a total return on investment (ROI) exceeding 10,000% since its launch. A similar view was shared by The Block (2024), which noted that most first-generation crypto billionaires were early investors in Bitcoin and Ethereum.

Meanwhile, CryptoRank data shows that Ethereum still holds the second-largest market capitalization in the global crypto market, trailing only behind Bitcoin. With a market cap of approximately US$400 billion, Ethereum has solidified its position as the largest blockchain supporting the development of decentralized finance (DeFi), NFTs, and smart contracts.

Several factors have contributed to Ethereum’s substantial price growth since its inception, including:

The widespread adoption of smart contracts and DeFi applications built on the Ethereum blockchain.

The transition to Ethereum 2.0, which introduced a Proof-of-Stake (PoS) consensus mechanism, significantly reducing energy consumption and improving scalability.

The booming demand for NFTs and Web3 applications, most of which are built within the Ethereum ecosystem.

Ethereum’s developer community, which remains the largest among all blockchain platforms.

This Ethereum investor’s story highlights the importance of having the courage to take risks, backed by thorough research and long-term investment patience—especially in emerging sectors like cryptocurrency. However, experts also caution that not every crypto investment will result in a success story like this one. The risk of loss remains high, particularly for those who invest without understanding the fundamentals of the assets they are buying.

What do you think about this topic? Tell us what you think. Don't forget to follow Digivestasi's Instagram, TikTok, Youtube accounts to keep you updated with the latest information about economics, finance, digital technology and digital asset investment.

DISCLAIMER

All information contained on our website is summarized from reliable sources and published in good faith and for the purpose of providing general information only. Any action taken by readers on information from this site is their own responsibility.