News Update

Get Ready: Indonesian Government Prepares Rp13 Trillion Eid Incentives

/index.php

Bisnis | Ekonomi - Posted on 02 February 2026 Reading time 5 minutes

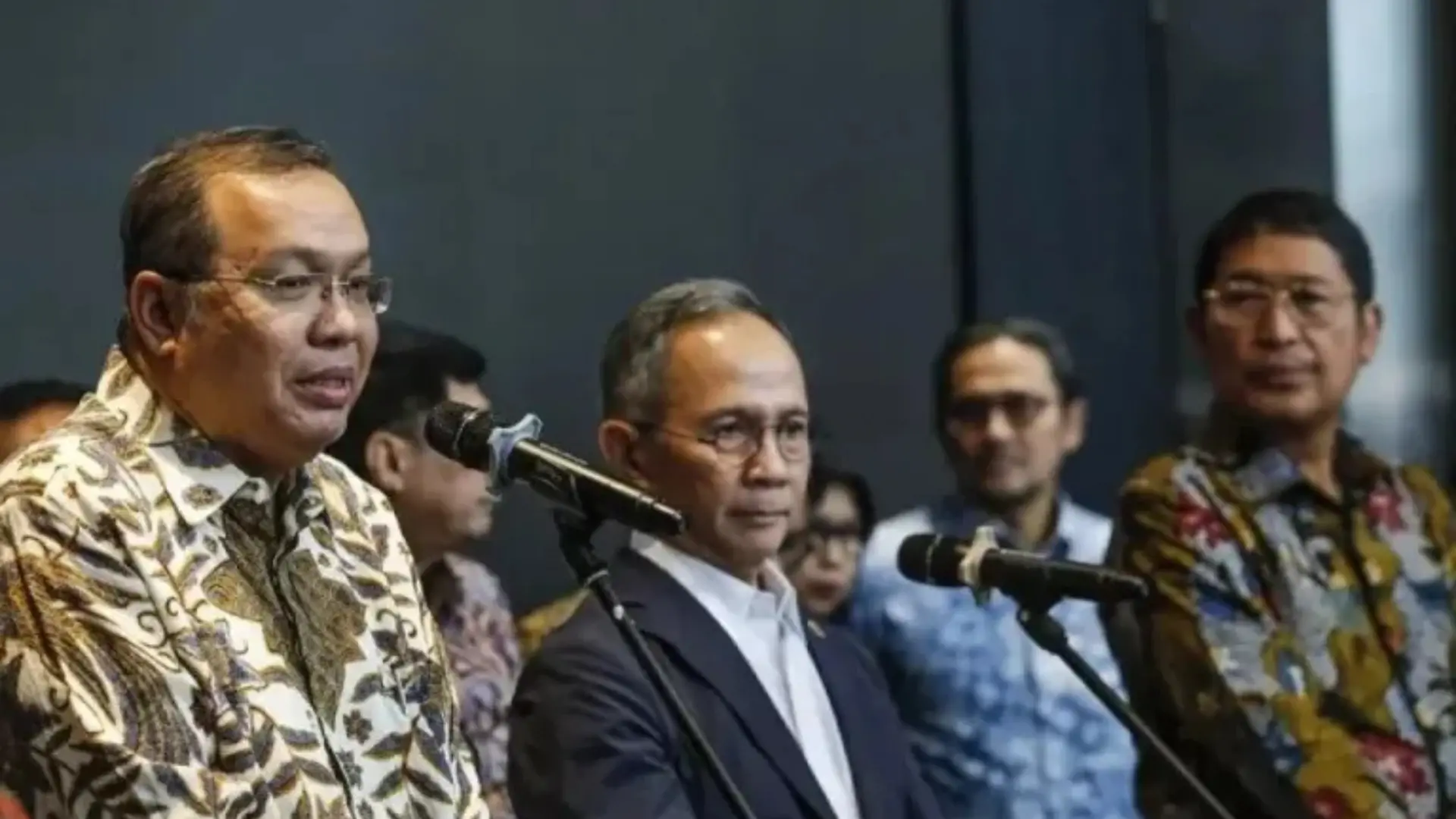

Three commissioners of Indonesia’s Financial Services Authority (OJK) have stepped down, namely Chairman Mahendra Siregar, Vice Chairman Mirza Adityaswara, and Commissioner Inarno Djajadi. Their resignations followed the earlier departure of Indonesia Stock Exchange (IDX) President Director Iman Rachman, who also resigned openly and with dignity. The official explanation presented to the public was moral responsibility after the stock market plunged by around 8 percent within hours of trading on Monday, January 26, 2026. Nevertheless, the wave of resignations has left the market riddled with unanswered questions.

The sharp market decline came after a review by Morgan Stanley Capital International (MSCI). However, some observers described the episode as a “bloodless coup,” capitalizing on the market downturn. Price volatility itself is hardly unusual and has occurred repeatedly in previous years.

Following the deep sell-off, trading was temporarily halted, and shortly thereafter the three OJK commissioners resigned. At the same time, calls for the demutualization of the IDX resurfaced, promoted as a near-miraculous solution. In fact, demutualization is already stipulated in Indonesia’s 2023 P2SK Law and only awaits a government regulation expected in the first half of 2026. President Prabowo has reportedly urged that the process be accelerated.

The transformation of the IDX from a member-owned “club” of brokerage firms into a modern corporation is widely portrayed as a cure for long-standing governance weaknesses and opaque practices. In this context, the sovereign investment body Daya Anagata Nusantara (Danantara) has signaled readiness to enter as a potential shareholder, despite also holding stakes in numerous state-owned enterprises listed on the exchange.

The real policy question, however, is not whether demutualization can be completed quickly, but whether it will genuinely strengthen the foundations of the capital market or instead undermine its core asset: trust.

According to a closed discussion at the Infobank Institute, at least two major risks emerge if Danantara becomes the controlling shareholder of the IDX. First is the erosion of governance. The current mutual ownership structure disperses power among brokers and securities firms, creating inefficiencies and internal bargaining but preventing any single dominant player from steering the exchange solely for its own benefit. Conflicts of interest are horizontal and mutually monitored, preserving a degree of neutrality.

Danantara’s entry could replace this fragmented structure with a centralized monopoly of state strategic interests. As an active and powerful asset manager, Danantara is far from a passive investor. Granting it control of the exchange would effectively place the referee under the ownership of a star player, creating structural, vertical, and systemic conflicts of interest that are fundamentally irresolvable.

The second issue concerns transparency. While the mutual structure is often criticized for limited openness, it still involves multiple stakeholders who watch one another. Under Danantara’s ownership, transparency faces a more paradoxical threat, given that the disclosure practices of sovereign wealth funds themselves are frequently questioned.

Danantara would wear two irreconcilable hats: an investment manager seeking to maximize returns through strategic agility and confidentiality, and an exchange owner obligated to enforce absolute transparency. This contradiction risks subordinating disclosure requirements to portfolio interests, making it increasingly difficult for the public to distinguish whether IDX policies serve the market as a whole or Danantara’s own investments.

Demutualization was originally intended to separate exchange ownership from active market participants to eliminate conflicts of interest. Allowing dominant state capital to take control distorts that purpose. Rather than curing slow governance, it risks replacing it with a far more dangerous disease: entrenched conflicts of interest.

Capital markets rest on trust, built upon exchange neutrality and uncompromised transparency. Bringing Danantara into IDX ownership in any significant form is not a remedy, but a poison that threatens both pillars. The proper path is a truly sterile demutualization that severs ownership ties with all active market players, public or private, ensuring the exchange genuinely belongs to the public.

Otherwise, demutualization will be remembered as an expensive power transaction, one that traded the integrity of Indonesia’s capital market for the illusion of efficiency and fresh capital. The MSCI-triggered market drop was merely the opening act; the deeper story behind the commissioners’ “bloodless” exit unfolded despite Indonesia’s capital market continuing to grow, with investor numbers surpassing 20 million.

Source: detik.com

What do you think about this topic? Tell us what you think. Don't forget to follow Digivestasi's Instagram, TikTok, Youtube accounts to keep you updated with the latest information about economics, finance, digital technology and digital asset investment.

DISCLAIMER

All information contained on our website is summarized from reliable sources and published in good faith and for the purpose of providing general information only. Any action taken by readers on information from this site is their own responsibility.